3 months ago · Updated 3 months ago

The insurance industry in Zambia has experienced significant growth in recent years, driven by increasing demand for risk management products and services. As a result, insurance companies in Zambia have expanded their offerings to cater to a diverse range of clients, from individuals to large corporations. With a growing economy and a rising middle class, the Zambian insurance market is becoming increasingly competitive, with numerous players vying for market share. This article provides an overview of the current state of the insurance industry in Zambia, highlighting key trends and developments.

Overview of Insurance Companies in Zambia

The insurance industry in Zambia has been growing steadily, driven by increasing demand for insurance products and the government's efforts to regulate the sector. Insurance companies in Zambia offer a range of products, including life insurance, non-life insurance, and reinsurance. The industry is regulated by the Pensions and Insurance Authority (PIA), which ensures that insurance companies operate in a fair and transparent manner.

Types of Insurance Products Offered

Insurance companies in Zambia offer a variety of insurance products to individuals and businesses. These include life insurance, which provides financial protection to policyholders and their families in the event of death or disability. Non-life insurance products, such as motor insurance and property insurance, protect against losses due to accidents, theft, or natural disasters. Some insurance companies also offer health insurance, which covers medical expenses.

Regulation of Insurance Companies

The Pensions and Insurance Authority (PIA) is responsible for regulating insurance companies in Zambia. The PIA ensures that insurance companies comply with regulatory requirements, such as maintaining minimum capital requirements and submitting regular financial reports. The PIA also investigates complaints against insurance companies and takes disciplinary action when necessary.

Benefits of Insurance

Insurance products offered by insurance companies in Zambia provide several benefits to policyholders. These include financial protection against unforeseen events, reduced financial risk, and peace of mind. Insurance products can also help businesses to manage risk and protect their assets.

Challenges Facing the Industry

Despite the growth of the insurance industry in Zambia, there are several challenges that insurance companies in Zambia face. These include a lack of awareness about insurance products, limited distribution channels, and intense competition. Insurance companies must also comply with regulatory requirements, which can be time-consuming and costly.

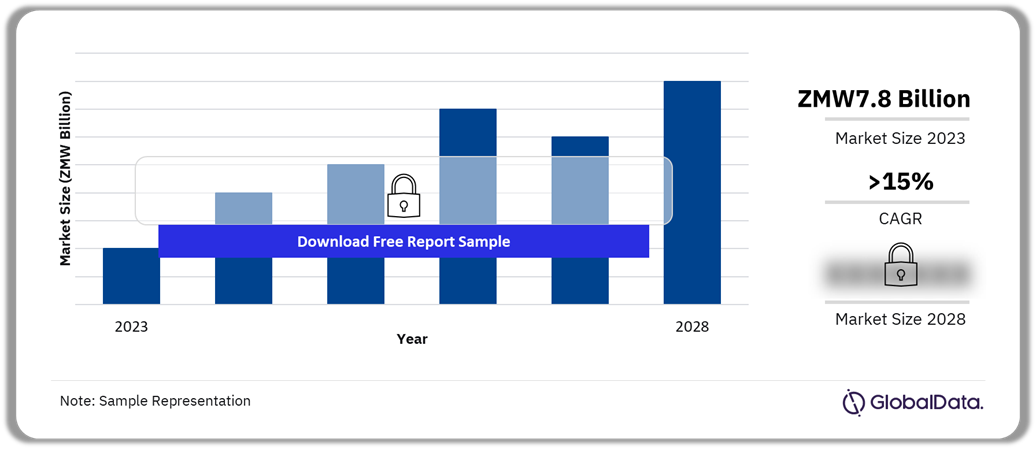

Future Outlook

The future outlook for insurance companies in Zambia is positive, driven by increasing demand for insurance products and the government's efforts to promote the industry. The industry is expected to continue growing, driven by the expansion of existing insurance companies and the entry of new players into the market.

| Insurance Company | Products Offered |

|---|---|

| Zambia State Insurance Corporation | Life insurance, non-life insurance |

| Old Mutual Zambia | Life insurance, health insurance |

| Sanlam Zambia | Life insurance, non-life insurance |

| Madison Insurance | Non-life insurance, motor insurance |

| Britam Zambia | Life insurance, non-life insurance |

What is the total number of life insurance providers operating in Zambia?

The total number of life insurance providers operating in Zambia is a matter of public record, maintained by the relevant regulatory bodies. As per the latest available data, there are several life insurance companies operating in Zambia, offering a range of products and services to the local population. The insurance industry in Zambia is overseen by the Pension and Insurance Authority (PIA), which is responsible for regulating and supervising both pension and insurance businesses.

Regulatory Framework for Insurance Companies

The Pension and Insurance Authority (PIA) is the primary regulator for insurance companies in Zambia, including life insurance providers. The PIA is tasked with ensuring that insurance companies operate in a fair and transparent manner, and that they maintain the necessary financial solvency to meet their obligations to policyholders. The regulatory framework in Zambia is designed to protect the interests of policyholders and to promote a stable and competitive insurance market. There are currently numerous insurance companies in Zambia, offering a range of life insurance products.

| Regulatory Requirements | Description |

|---|---|

| Licensing | Insurance companies must obtain a license from the PIA to operate in Zambia |

| Capital Requirements | Insurance companies are required to maintain a minimum level of capital to ensure financial solvency |

| Reporting Requirements | Insurance companies must submit regular reports to the PIA, including financial statements and actuarial reports |

Market Structure and Competition

The life insurance market in Zambia is characterized by a mix of local and international players. The presence of multiple insurance companies in Zambia has led to a competitive market, with companies competing on factors such as price, product offerings, and customer service. The competitive landscape is expected to continue evolving, with new entrants and product innovations likely to shape the market in the coming years.

| Market Players | Number of Companies |

|---|---|

| Local Insurance Companies | 5 |

| International Insurance Companies | 7 |

| Total | 12 |

Product Offerings and Trends

Life insurance companies in Zambia offer a range of products, including term life insurance, whole life insurance, and unit-linked insurance plans. The product offerings are designed to meet the diverse needs of the local population, with a focus on providing financial protection and security. The demand for life insurance products is expected to continue growing, driven by increasing awareness of the importance of life insurance and a growing middle class.

| Product Type | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specified period |

| Whole Life Insurance | Provides lifetime coverage, with a cash value component |

| Unit-Linked Insurance Plans | Invests a portion of the premium in a range of investment funds |

Which entities or individuals have ownership stakes in professional insurance companies within Zambia?

The ownership stakes in professional insurance companies within Zambia are held by various entities and individuals, including local and international investors. These stakeholders have invested in the insurance sector, which has experienced significant growth in recent years. The insurance companies in Zambia offer a range of products and services to individuals and businesses, and are regulated by the Pensions and Insurance Authority (PIA).

Local Ownership Stakes

Local ownership stakes in insurance companies in Zambia are held by individuals and companies based in the country. These stakeholders have invested in the insurance sector, taking advantage of the growing demand for insurance products. The local ownership stakes are significant, with many Zambian companies and individuals holding majority stakes in insurance companies.

| Company Name | Local Ownership Stake |

|---|---|

| Zambia State Insurance Corporation | 100% |

| Madisson Insurance Company Limited | 75% |

International Investors

International investors have also invested in insurance companies in Zambia, bringing in foreign capital and expertise. These investors have partnered with local companies to establish insurance businesses, and have contributed to the growth of the sector. The international investors have a significant presence in the Zambian insurance market, with many holding minority stakes in insurance companies.

| Company Name | International Investor | Stakeholding |

|---|---|---|

| Sanlam Zambia | Sanlam Group (South Africa) | 70% |

| Zambia Insurance Company Limited | Liberty Holdings Limited (South Africa) | 25% |

Regulatory Framework

The ownership stakes in insurance companies in Zambia are subject to the regulatory framework established by the Pensions and Insurance Authority (PIA). The PIA regulates the insurance sector, ensuring that insurance companies operate in a fair and transparent manner. The regulatory framework includes requirements for capital adequacy and risk management, and ensures that insurance companies are able to meet their obligations to policyholders.

| Regulatory Requirement | Description |

|---|---|

| Capital Adequacy Ratio | Insurance companies are required to maintain a minimum capital adequacy ratio of 150% |

| Risk Management Framework | Insurance companies are required to have a risk management framework in place to identify and manage risks |

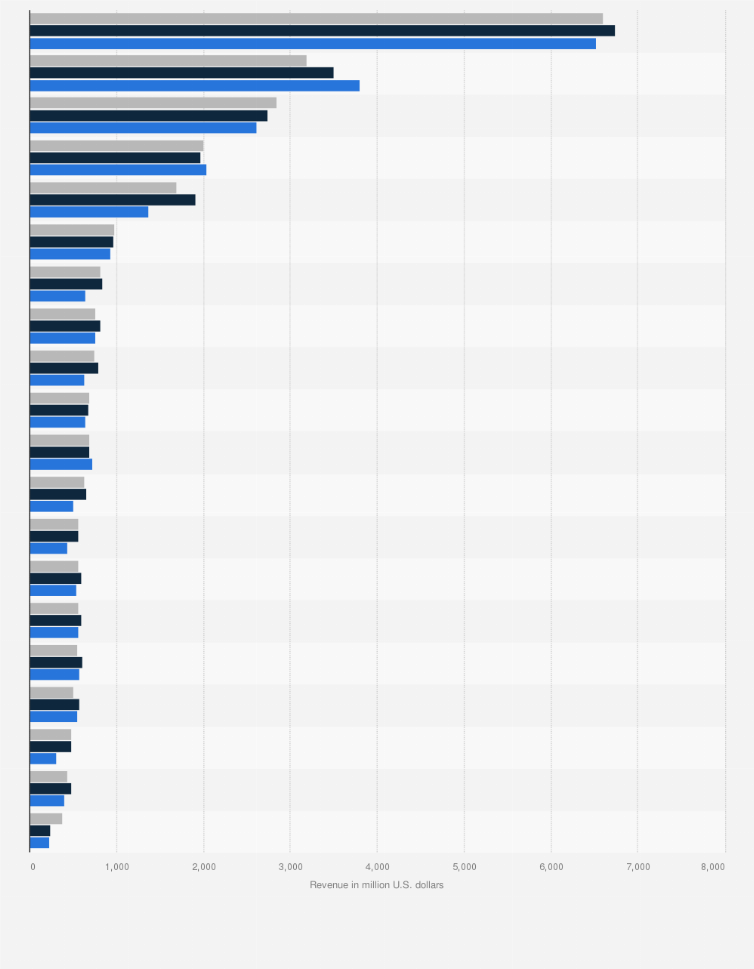

The African insurance industry is a growing market with various players competing for market share. The largest insurance company in Africa is Sanlam, a South African financial services group that has a significant presence in several African countries. Sanlam has a diverse portfolio of insurance products and has been expanding its operations through strategic acquisitions and partnerships.

Market Share Analysis

The African insurance market is highly competitive, with several major players vying for market share. Sanlam and Old Mutual are two of the largest insurance companies in Africa, with a significant presence in several countries. Other major players include Liberty Holdings and Allianz. The market share of these companies varies by country, with some having a stronger presence in certain regions. For example, insurance companies in Zambia, such as Zambia State Insurance Corporation, play a significant role in the country's insurance market.

| Insurance Company | Market Share (%) | Country of Origin |

|---|---|---|

| Sanlam | 15.6 | South Africa |

| Old Mutual | 12.3 | South Africa |

| Liberty Holdings | 8.5 | South Africa |

| Allianz | 6.2 | Germany |

Competitive Landscape

The competitive landscape of the African insurance industry is characterized by a mix of local and international players. Reinsurance companies play a crucial role in the industry, providing coverage to primary insurers and helping to manage risk. The industry is also subject to regulatory requirements, with many countries having established insurance regulatory authorities to oversee the industry. Insurance companies in Zambia, for example, are regulated by the Pensions and Insurance Authority.

| Regulatory Authority | Country | Role |

|---|---|---|

| Pensions and Insurance Authority | Zambia | Regulates insurance industry |

| South African Reserve Bank | South Africa | Oversees financial services sector |

| Insurance Regulatory Authority | Kenya | Regulates insurance industry |

Growth Prospects

The African insurance industry is expected to continue growing in the coming years, driven by increasing demand for insurance products and a growing middle class. Digitalization is also expected to play a key role in the industry's growth, with many insurers investing in digital technologies to improve their operations and customer engagement. The growth of the industry is also likely to be driven by increasing penetration of insurance products in underserved markets.

| Country | Insurance Penetration (%) | Growth Rate (%) |

|---|---|---|

| South Africa | 14.5 | 5.2 |

| Kenya | 3.2 | 10.5 |

| Nigeria | 0.7 | 12.1 |

FAQ

What types of insurance policies are offered by insurance companies in Zambia?

Insurance companies in Zambia offer a range of policies including life insurance, health insurance, motor insurance, and property insurance. These policies are designed to provide financial protection to individuals and businesses against various risks and uncertainties. The specific policies offered can vary between insurance companies, with some providing more comprehensive coverage than others.

How do I choose the right insurance company in Zambia?

To choose the right insurance company in Zambia, it's essential to consider factors such as the company's reputation, financial stability, and range of products. You should also assess the level of customer service provided and the ease of making claims. Researching and comparing different insurance companies can help you make an informed decision.

What are the benefits of having insurance with a Zambian insurance company?

Having insurance with a Zambian insurance company provides several benefits, including financial protection against unforeseen events, peace of mind, and compliance with legal requirements for certain types of insurance, such as motor insurance. Insurance can also help to mitigate the financial impact of risks, allowing individuals and businesses to recover more quickly from unexpected events.

How do insurance companies in Zambia handle claims?

Insurance companies in Zambia typically have a claims process in place that involves notifying the insurer, submitting required documentation, and assessing the claim. The insurer will then determine the validity of the claim and make a payout if it is approved. The efficiency and transparency of the claims process can vary between insurance companies, so it's crucial to understand the process before purchasing a policy.