4 months ago · Updated 4 months ago

Standard Chartered Bank Zambia is a leading financial institution in the country, providing a wide range of banking services to individuals and businesses. With a history dating back several decades, the bank has established itself as a trusted and reliable partner for customers. As a subsidiary of the global Standard Chartered Group, Standard Chartered Bank Zambia benefits from a vast international network, enabling it to offer competitive products and services. The bank's commitment to innovation and customer satisfaction has earned it a reputation as one of Zambia's premier banking institutions. Its extensive branch network supports local economic growth.

-

Overview of Standard Chartered Bank Zambia

- History and Background of Standard Chartered Bank Zambia

- Products and Services Offered by Standard Chartered Bank Zambia

- Digital Banking Solutions by Standard Chartered Bank Zambia

- Corporate Social Responsibility Initiatives by Standard Chartered Bank Zambia

- Financial Performance of Standard Chartered Bank Zambia

-

Comprehensive Overview of Standard Chartered Bank Zambia Services and Operations

- What are the available contact methods for Standard Chartered Bank Zambia's customer service?

- Are there any plans for Standard Chartered Bank to cease operations in Zambia?

- What is the required minimum balance to open a new account with Standard Chartered Bank Zambia?

- Who is currently serving as the Chief Executive Officer of Standard Chartered Bank Zambia?

- FAQ

Overview of Standard Chartered Bank Zambia

Standard Chartered Bank Zambia is a leading banking institution in Zambia, providing a comprehensive range of financial services to individuals, businesses, and institutions. With a strong presence in the country, the bank has established itself as a trusted partner for customers seeking reliable and innovative banking solutions.

History and Background of Standard Chartered Bank Zambia

Standard Chartered Bank Zambia has a rich history dating back to its establishment in the country. As a part of the global Standard Chartered Bank network, it leverages its parent company's expertise and resources to deliver world-class banking services. Over the years, the bank has played a significant role in Zambia's economic development by providing financial support to various sectors, including agriculture, mining, and manufacturing.

Products and Services Offered by Standard Chartered Bank Zambia

The bank offers a diverse portfolio of products and services, catering to the diverse needs of its customers. These include personal banking services, such as savings accounts, credit cards, and personal loans, as well as business banking solutions, including cash management, trade finance, and corporate banking. Additionally, Standard Chartered Bank Zambia provides investment and insurance services, enabling customers to achieve their financial goals.

Digital Banking Solutions by Standard Chartered Bank Zambia

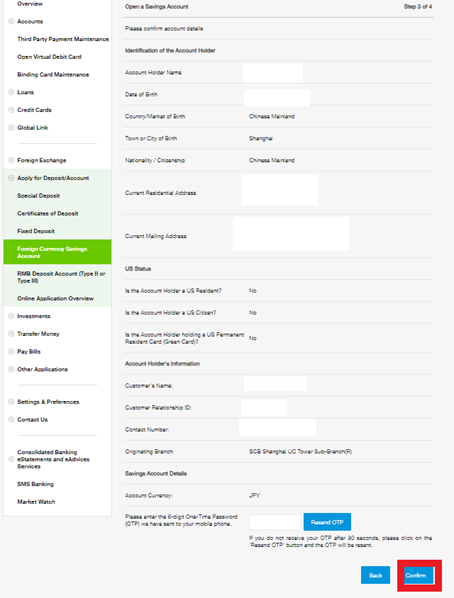

In line with its commitment to innovation, Standard Chartered Bank Zambia has introduced a range of digital banking solutions, making it easier for customers to manage their finances. These include mobile banking, online banking, and digital payment solutions, allowing customers to access banking services conveniently and securely.

Standard Chartered Bank Zambia is dedicated to making a positive impact on the communities it serves. The bank has implemented various corporate social responsibility initiatives, focusing on areas such as education, healthcare, and environmental sustainability. These initiatives demonstrate the bank's commitment to being a responsible corporate citizen.

Financial Performance of Standard Chartered Bank Zambia

The bank has consistently delivered strong financial performance, driven by its robust business model and prudent risk management practices. Standard Chartered Bank Zambia's financial stability and capital strength enable it to support the growth needs of its customers and contribute to the overall development of Zambia's economy.

| Product/Service | Description |

|---|---|

| Personal Banking | Savings accounts, credit cards, personal loans |

| Business Banking | Cash management, trade finance, corporate banking |

| Digital Banking | Mobile banking, online banking, digital payment solutions |

| Investment and Insurance | Investment products, insurance services |

Comprehensive Overview of Standard Chartered Bank Zambia Services and Operations

What are the available contact methods for Standard Chartered Bank Zambia's customer service?

The available contact methods for Standard Chartered Bank Zambia's customer service include phone, email, and online chat. Customers can reach out to the bank's customer service team through various channels to inquire about their products and services, report issues, or request assistance.

Phone Contact

Customers can contact Standard Chartered Bank Zambia by phone by calling their customer service hotline. The phone number is available on the bank's website and is typically available 24/7 to cater to customers' needs. By calling the hotline, customers can speak to a customer service representative who can assist with their queries or concerns.

| Phone Number | +260 211 399 300 |

| Availability | 24/7 |

Email and Online Contact

Customers can also contact the bank through email or online contact forms available on the bank's website. By sending an email or filling out the online contact form, customers can reach out to the bank's customer service team with their queries or concerns. The customer service team will respond to the customer's inquiry via email.

| Contact Method | Details |

|---|---|

| sc.zm.customerservice@sc.com | |

| Online Contact Form | Available on the Standard Chartered Bank Zambia website |

Branch and ATM Locator

Customers can also visit a Standard Chartered Bank Zambia branch or ATM to get assistance from the bank's customer service team. The bank's website provides a branch and ATM locator tool that allows customers to find the nearest branch or ATM location. By visiting a branch or ATM, customers can speak to a customer service representative in person.

| Branch/ATM Details | Information |

|---|---|

| Branch Locator | Available on the bank's website |

| ATM Locator | Available on the bank's website |

Are there any plans for Standard Chartered Bank to cease operations in Zambia?

There have been no official announcements from Standard Chartered Bank regarding plans to cease operations in Zambia. The bank has maintained a significant presence in the country, providing a range of financial services to individuals and businesses. As one of the major banks in Zambia, Standard Chartered Bank Zambia plays a crucial role in the country's financial sector, supporting trade and investment activities.

Standard Chartered Bank Zambia's Current Operations

Standard Chartered Bank Zambia continues to operate a network of branches and ATMs across the country, offering various banking products and services. The bank's operations in Zambia are part of its broader strategy to support economic growth and development in the region. With a focus on digital banking and customer service, Standard Chartered Bank Zambia aims to remain competitive in the Zambian banking market.

| Service | Description |

|---|---|

| Personal Banking | Offers a range of personal banking products, including current and savings accounts, credit cards, and personal loans. |

| Business Banking | Provides business banking solutions, including cash management, trade finance, and corporate lending. |

Regulatory Environment in Zambia

The banking sector in Zambia is regulated by the Bank of Zambia, which oversees the operations of commercial banks, including Standard Chartered Bank Zambia. The regulatory environment plays a crucial role in shaping the banking landscape in Zambia, with a focus on maintaining financial stability and protecting consumers. Standard Chartered Bank Zambia is required to comply with various regulations and guidelines set by the Bank of Zambia.

| Regulatory Requirement | Description |

|---|---|

| Capital Adequacy Ratio | Requires banks to maintain a minimum capital adequacy ratio to ensure they have sufficient capital to cover risks. |

| Anti-Money Laundering (AML) Regulations | Mandates banks to implement AML measures to prevent and detect money laundering activities. |

Future Prospects for Standard Chartered Bank Zambia

The future prospects for Standard Chartered Bank Zambia are closely tied to the overall performance of the Zambian economy and the banking sector. The bank is likely to continue to focus on digital transformation and innovative banking solutions to remain competitive. As part of its strategy, Standard Chartered Bank Zambia may explore new opportunities to expand its customer base and increase its market share in Zambia.

| Initiative | Description |

|---|---|

| Digital Banking Platform | Aims to enhance the bank's digital banking capabilities, providing customers with a seamless and convenient banking experience. |

| Customer Engagement | Focuses on improving customer engagement through various channels, including social media and customer feedback mechanisms. |

What is the required minimum balance to open a new account with Standard Chartered Bank Zambia?

The required minimum balance to open a new account with Standard Chartered Bank Zambia varies depending on the type of account. The bank offers various account types, including current accounts, savings accounts, and fixed deposit accounts, each with its own minimum balance requirement.

Minimum Balance Requirements for Current Accounts

To open a current account with Standard Chartered Bank Zambia, the minimum balance required is typically around ZMW 500. This type of account is suitable for individuals and businesses that require frequent transactions. The account comes with a range of features, including debit cards, cheque books, and online banking facilities.

| Account Type | Minimum Balance (ZMW) | Features |

|---|---|---|

| Current Account | 500 | Debit card, cheque book, online banking |

Savings Account Minimum Balance Requirements

For savings accounts offered by Standard Chartered Bank Zambia, the minimum balance required to open an account is generally lower than that of current accounts, typically around ZMW 100. Savings accounts are designed for individuals who want to save money over time and earn interest on their deposits. These accounts often come with features such as online banking and mobile banking.

| Account Type | Minimum Balance (ZMW) | Interest Rate (%) |

|---|---|---|

| Savings Account | 100 | 2.5 |

Fixed Deposit Account Requirements

Standard Chartered Bank Zambia also offers fixed deposit accounts, which require a minimum deposit that can vary significantly, often starting from around ZMW 5,000. Fixed deposit accounts are time deposit accounts that provide a fixed interest rate for a specified period. They are suitable for individuals who want to invest their money for a fixed term and earn a higher interest rate than a traditional savings account.

| Tenor (Days) | Minimum Deposit (ZMW) | Interest Rate (%) |

|---|---|---|

| 30 | 5,000 | 4.0 |

| 90 | 5,000 | 5.0 |

| 180 | 5,000 | 6.0 |

Who is currently serving as the Chief Executive Officer of Standard Chartered Bank Zambia?

The current Chief Executive Officer of Standard Chartered Bank Zambia is George Nkombo. He is responsible for overseeing the overall strategy and direction of the bank, ensuring its continued growth and success in the Zambian market.

Background and Experience

George Nkombo has extensive experience in the banking industry, having worked in various roles across different countries. Prior to his appointment as CEO of Standard Chartered Bank Zambia, he held senior positions in other financial institutions, where he gained a deep understanding of the complexities of the banking sector. His experience has equipped him with the skills necessary to navigate the challenges facing Standard Chartered Bank Zambia.

| Name | George Nkombo |

| Position | Chief Executive Officer |

| Bank | Standard Chartered Bank Zambia |

Key Responsibilities

As the CEO of Standard Chartered Bank Zambia, George Nkombo is responsible for driving the bank's growth strategy, overseeing its risk management practices, and ensuring compliance with regulatory requirements. He is also tasked with maintaining strong relationships with the bank's stakeholders, including customers, employees, and investors. Under his leadership, Standard Chartered Bank Zambia aims to continue providing innovative financial solutions to its customers.

| Responsibility | Description |

|---|---|

| Strategy Development | Developing and implementing the bank's growth strategy |

| Risk Management | Overseeing the bank's risk management practices |

| Stakeholder Relations | Maintaining strong relationships with customers, employees, and investors |

Future Outlook

Under George Nkombo's leadership, Standard Chartered Bank Zambia is expected to continue its commitment to providing high-quality financial services to its customers. The bank is likely to focus on expanding its product offerings and enhancing its digital capabilities to meet the evolving needs of its customers. As the banking landscape in Zambia continues to evolve, Standard Chartered Bank Zambia is well-positioned to capitalize on emerging opportunities.

| Area | Focus |

|---|---|

| Digital Banking | Enhancing digital capabilities to improve customer experience |

| Product Offerings | Expanding product offerings to meet evolving customer needs |

| Customer Service | Continuing to provide high-quality customer service |

FAQ

What services does Standard Chartered Bank Zambia offer?

Standard Chartered Bank Zambia provides a wide range of banking services, including personal banking, corporate banking, and investment banking. The bank offers various products such as credit cards, loans, and savings accounts that cater to the diverse needs of its customers. With a strong focus on digital banking, the bank has also introduced innovative online and mobile banking platforms to make banking more convenient.

How can I open an account with Standard Chartered Bank Zambia?

To open an account with Standard Chartered Bank Zambia, you can visit any of their branches or sub-branches across the country. You will be required to provide the necessary identification documents and proof of address. The bank's customer service representatives will guide you through the account opening process, which is designed to be simple and efficient. You can also visit the bank's website to learn more about the required documents and the account opening process.

What are the benefits of using Standard Chartered Bank Zambia's online banking services?

Standard Chartered Bank Zambia's online banking services offer a range of benefits, including convenience, flexibility, and security. With online banking, you can manage your accounts, pay bills, and transfer funds from the comfort of your own home or office. The bank's online banking platform is designed to be user-friendly and secure, with advanced security features to protect your transactions.

How does Standard Chartered Bank Zambia support local businesses?

Standard Chartered Bank Zambia is committed to supporting local businesses through various initiatives and products. The bank offers trade finance solutions, cash management services, and lending facilities to help businesses grow and expand. By providing these services, the bank aims to contribute to the development of the local economy and support the growth of small and medium-sized enterprises (SMEs).