5 months ago · Updated 5 months ago

In Zambia, individuals facing unemployment often encounter significant financial challenges, making it difficult to meet their basic needs. Fortunately, various financial institutions and microfinance organizations offer 'loans for unemployed in Zambia' to help alleviate these difficulties. These loans provide an opportunity for the unemployed to access funds for personal or business purposes, thereby enhancing their financial stability. This article examines the available options, eligibility criteria, and application processes for such loans, shedding light on how they can be a viable solution for those in need of financial assistance in Zambia.

- Understanding Loans for Unemployed in Zambia

-

A Comprehensive Guide to Loans for Unemployed in Zambia: Options and Eligibility

- What loan options are available for individuals currently unemployed in Zambia?

- What are the eligibility criteria and application process for Power Kwacha loans in Zambia for unemployed individuals?

- How can unemployed individuals in Zambia apply for Kongola loans and what are the required documents?

- FAQ

Understanding Loans for Unemployed in Zambia

In Zambia, individuals who are unemployed often face significant challenges in accessing financial assistance due to the lack of a stable income. However, there are various financial institutions and microfinance organizations that offer loans for unemployed in Zambia, designed to help individuals meet their financial needs. These loans can be used for various purposes, including starting a small business, covering emergency expenses, or supporting personal projects.

Eligibility Criteria for Loans for Unemployed in Zambia

To qualify for loans for unemployed in zambia, applicants typically need to meet certain eligibility criteria. These may include having a viable business plan, providing collateral or a guarantor, and demonstrating the ability to repay the loan. Some lenders may also consider the applicant's credit history and other factors.

Types of Loans Available for Unemployed Individuals in Zambia

There are several types of loans available for unemployed individuals in Zambia, including microloans, personal loans, and group loans. Microloans are particularly popular among unemployed individuals, as they offer smaller loan amounts with flexible repayment terms. Some lenders also offer Islamic loans that comply with Sharia law.

Benefits of Loans for Unemployed in Zambia

Loans for unemployed in Zambia can provide several benefits, including the opportunity to start a new business, cover essential expenses, and improve overall financial stability. By accessing these loans, individuals can also build their credit history and develop a positive credit profile.

Challenges Associated with Loans for Unemployed in Zambia

While loans for unemployed in Zambia can be beneficial, there are also potential challenges to consider. These may include high interest rates, strict repayment terms, and the risk of debt accumulation. Borrowers must carefully review the loan terms and conditions to ensure they understand their obligations.

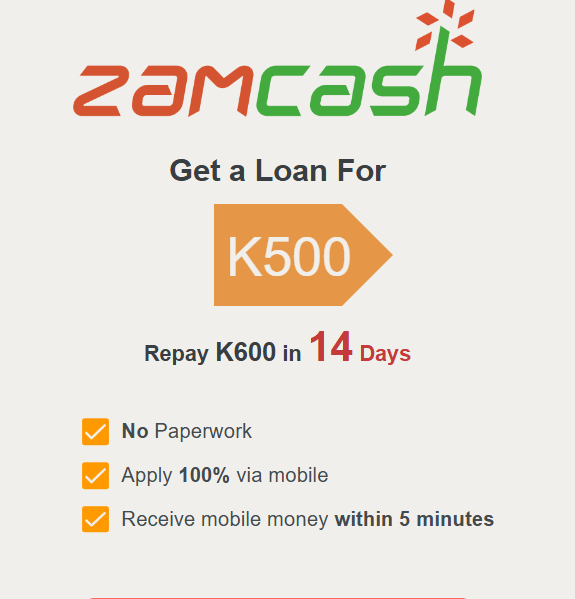

Popular Lenders Offering Loans for Unemployed in Zambia

Several lenders in Zambia offer loans for unemployed in zambia, including microfinance institutions, banks, and online lenders. Some popular lenders include institutions that specialize in microfinance and small business loans.

| Lender | Loan Amount | Interest Rate | Repayment Term |

|---|---|---|---|

| Microfinance Institution A | ZMW 10,000 - ZMW 50,000 | 15% - 20% per annum | 6 - 12 months |

| Bank B | ZMW 5,000 - ZMW 20,000 | 12% - 18% per annum | 3 - 6 months |

| Online Lender C | ZMW 2,000 - ZMW 10,000 | 20% - 25% per annum | 1 - 3 months |

It is essential for borrowers to compare the loan offers from different lenders and choose the one that best suits their needs, considering factors such as interest rates, repayment terms, and loan amounts.

A Comprehensive Guide to Loans for Unemployed in Zambia: Options and Eligibility

What loan options are available for individuals currently unemployed in Zambia?

Individuals currently unemployed in Zambia can explore various loan options, although the availability and terms may vary depending on the lender and the borrower's circumstances. Microfinance institutions and some banks offer loans for unemployed individuals, often with more flexible eligibility criteria than traditional employment-based loans. These loans may be used for various purposes, including starting a business or covering emergency expenses.

Types of Loans Available

Unemployed individuals in Zambia can access different types of loans, including microloans and personal loans. Loans for unemployed in Zambia are often provided by microfinance institutions that cater to individuals with limited or no employment history. These loans typically have shorter repayment terms and may require collateral or a guarantor.

| Loan Type | Interest Rate | Repayment Term |

|---|---|---|

| Microloan | 15% - 30% per annum | 3 - 12 months |

| Personal Loan | 20% - 40% per annum | 6 - 24 months |

Eligibility Criteria

To be eligible for loans for unemployed individuals in Zambia, applicants typically need to meet certain requirements, such as having a viable business plan or alternative sources of income. Lenders may also consider the applicant's credit history and ability to provide collateral or a guarantor. Some lenders may offer unsecured loans, but these often come with higher interest rates.

| Eligibility Criteria | Requirements |

|---|---|

| Business Plan | A viable business plan outlining loan usage and repayment strategy |

| Alternative Income | Proof of alternative income sources, such as rental income or remittances |

| Credit History | A satisfactory credit history or a guarantor with a good credit score |

Application Process

The application process for loans for unemployed individuals in Zambia typically involves submitting a loan application, providing required documentation, and awaiting approval. Applicants may need to provide identification documents, proof of income or business plans, and other supporting documents. Lenders may also conduct credit checks and verify the applicant's information before approving the loan.

| Required Documents | Description |

|---|---|

| Identification | National ID or passport |

| Business Plan | A detailed business plan outlining loan usage and repayment strategy |

| Proof of Income | Documentation showing alternative income sources or proof of business income |

What are the eligibility criteria and application process for Power Kwacha loans in Zambia for unemployed individuals?

The eligibility criteria for Power Kwacha loans in Zambia for unemployed individuals primarily revolve around the applicant's ability to repay the loan, despite not being formally employed. To be eligible, applicants typically need to be Zambian citizens, have a valid NRC (National Registration Card), and be between the ages of 18 and 60. Additionally, they must have a bank account, preferably with a bank that is linked to the loan provider, and be able to provide proof of income or a regular income source, which could be from informal employment or other means. The loan provider assesses the applicant's creditworthiness based on their repayment history and other factors. Loans for unemployed in Zambia are designed to support individuals who lack formal employment but have other means of generating income.

Required Documents for Application

To apply for Power Kwacha loans, unemployed individuals in Zambia need to provide specific documents. These typically include a valid NRC, proof of address, and proof of income. The proof of income can be in various forms, such as receipts from informal trading, remittances, or other regular income sources. The loan provider may also require bank statements to assess the applicant's financial history and ability to repay the loan. Ensuring that all required documents are in order can facilitate a smoother application process.

| Document Type | Description |

|---|---|

| NRC | National Registration Card, a mandatory identification document for Zambian citizens. |

| Proof of Address | Utility bills or other documents that confirm the applicant's residential address. |

| Proof of Income | Documents or receipts showing regular income, such as from informal employment or remittances. |

| Bank Statements | Recent bank statements to assess the applicant's financial history and repayment capability. |

Application Process Overview

The application process for Power Kwacha loans involves several steps, starting with the submission of the required documents and an application form. The loan provider reviews the application, assessing the applicant's eligibility and creditworthiness. This may involve verifying the provided documents and checking the applicant's credit history. If the application is approved, the loan amount is disbursed into the applicant's bank account. The entire process is designed to be efficient, with some loan providers offering online applications to simplify the process for unemployed individuals seeking financial assistance.

| Application Step | Description |

|---|---|

| Submission | Applicants submit the required documents and application form to the loan provider. |

| Review and Verification | The loan provider reviews the application and verifies the submitted documents. |

| Approval and Disbursement | If approved, the loan amount is disbursed into the applicant's bank account. |

| Repayment | The applicant repays the loan according to the agreed terms and schedule. |

Repayment Terms and Conditions

The repayment terms for Power Kwacha loans are designed to be flexible, accommodating the financial circumstances of loans for unemployed in Zambia. The loan provider sets a repayment schedule based on the loan amount, interest rate, and the applicant's financial situation. Repayment can often be made through various channels, including bank transfers, mobile payments, or at designated payment centers. Understanding the repayment terms and conditions is crucial for borrowers to manage their debt effectively and avoid any potential penalties for late or missed payments.

| Repayment Aspect | Description |

|---|---|

| Repayment Schedule | A personalized schedule based on the loan amount and the borrower's financial situation. |

| Interest Rate | The rate at which interest is charged on the loan, varying by loan provider. |

| Payment Channels | Various channels available for making repayments, such as bank transfers and mobile payments. |

| Penalties for Late Payment | Charges or penalties applied for missed or late payments, as per the loan agreement. |

How can unemployed individuals in Zambia apply for Kongola loans and what are the required documents?

Unemployed individuals in Zambia can apply for Kongola loans by meeting the lender's eligibility criteria, which typically includes being a Zambian citizen, having a valid national registration card, and a bank account. The application process usually involves submitting an online application or visiting a physical branch. The lender will then assess the applicant's creditworthiness, although some lenders may not perform traditional credit checks for loans for unemployed in zambia, instead, they might consider alternative forms of income or collateral.

Eligibility Criteria for Kongola Loans

To be eligible for Kongola loans, unemployed individuals must meet specific requirements, including age, residency, and identity verification. The lender may also consider the applicant's ability to repay the loan, which can be challenging for the unemployed. However, some lenders offer loans for unemployed in zambia with flexible repayment terms or alternative income verification methods.

| Eligibility Criteria | Requirements |

| Age | 18 years and above |

| Residency | Zambian citizen or resident |

| Identity Verification | Valid national registration card |

Required Documents for Kongola Loans Application

The required documents for a Kongola loan application typically include a valid national registration card, proof of address, and bank account details. Unemployed individuals may also need to provide additional documentation, such as a letter explaining their financial situation or alternative income sources. Lenders offering loans for unemployed in zambia may have varying document requirements, so it's essential to check with the lender directly.

| Document Type | Description |

| National Registration Card | Valid NRC for identity verification |

| Proof of Address | Utility bill or tenancy agreement |

| Bank Account Details | Bank statement or account number |

Application Process for Kongola Loans

The application process for Kongola loans involves submitting an online application or visiting a physical branch. Unemployed individuals should ensure they meet the lender's eligibility criteria before applying. The lender will then assess the application, considering factors such as creditworthiness and repayment ability. Some lenders specialize in offering loans for unemployed in zambia, providing an opportunity for individuals to access funds during challenging times.

| Application Step | Description |

| Online Application | Submit application through lender's website |

| Physical Branch Visit | Visit a branch to submit application |

| Application Assessment | Lender reviews application and makes a decision |

FAQ

What are the requirements for getting a loan as an unemployed individual in Zambia?

To qualify for a loan as an unemployed individual in Zambia, one typically needs to meet certain criteria set by lenders, which may include having a viable business plan if you're seeking a loan for entrepreneurial purposes, or having alternative forms of income or collateral. Some lenders may also consider your credit history and other factors.

Are there specific loan options available for the unemployed in Zambia?

Yes, there are loan options designed for unemployed individuals in Zambia, such as microfinance loans or small business loans that can help start a business or support personal needs. These loans are often provided by microfinance institutions or financial cooperatives that cater to individuals without traditional employment.

How can an unemployed person in Zambia apply for a loan?

An unemployed person in Zambia can apply for a loan by approaching financial institutions, microfinance lenders, or online lending platforms that offer services to the unemployed. The application process typically involves submitting required documents, such as identification, a business plan if applicable, and other supporting information.

What are the risks associated with taking a loan while being unemployed in Zambia?

Taking a loan while being unemployed in Zambia comes with risks, including the potential inability to repay the loan due to lack of a stable income. This can lead to debt accumulation, damage to one's credit score, and even legal consequences in extreme cases. It's crucial to carefully assess one's financial situation and consider alternative options before taking on debt.